SAN MATEO, CA February 15, 2018 – Bertram Capital (“Bertram”), announced the successful closing of Bertram Growth Capital III, L.P. & Bertram Growth Capital III-A, L.P. (the “Fund” or “Fund III”), with $500 million of total capital commitments from limited partners. This is the third fund for Bertram, a middle market private equity firm focused on control transactions that leverage its highly differentiated value creation strategy. The Fund closed at its target and hard cap, receiving commitments from over 30 top-tier investors, including endowments, insurance companies, multi-manager funds, consultants, public pensions, corporate pensions and family offices.

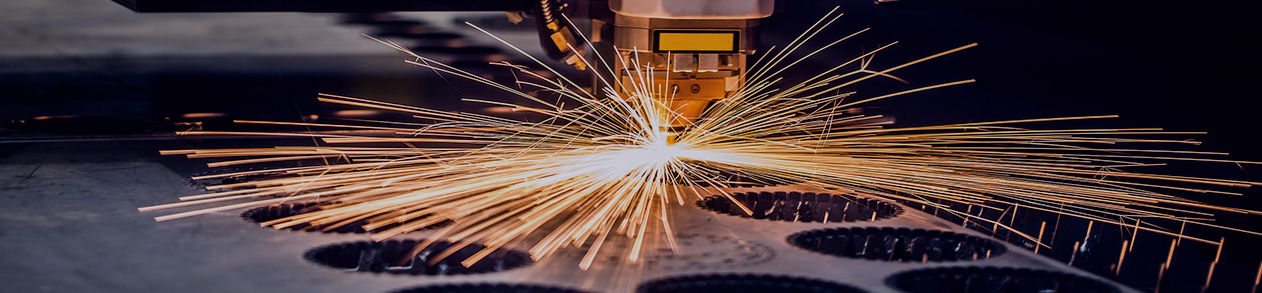

Like its two preceding funds, Fund III will continue Bertram’s demonstrated model of accelerating growth and driving operational improvements to transform under-optimized businesses into market leaders. Bertram leverages its highly differentiated in-house technology team, Bertram Labs, to drive value creation through proprietary IT initiatives in its portfolio companies. The Fund will focus on investing in companies generally with a minimum of $25 million in revenue and $5 million in EBITDA in the business services, consumer, and industrial/manufacturing sectors. The firm is led by its executive partnership team of Jeff Drazan, Kevin Yamashita, Ryan Craig, Jared Ruger, David Hellier, Ingrid Swenson and Brian Wheeler.

“Bertram greatly appreciates the support of our limited partners in the strategy we have developed over the last 12 years. We are off to a great start, having already deployed capital and co-investment in three platform investments,” said Jeff Drazan, Managing Partner at Bertram. “The successful fundraise is the result of effectively employing a differentiated investment strategy and building a cohesive, committed team. We would also like to thank Sixpoint Partners for their role in this successful fundraise.”

Bertram has made three Fund III platform investments in its focus industry sectors: Anord/Mardix (industrial), Spectrio (business services) and Trademark Global (consumer). Additionally, Bertram has already completed seven add-on acquisitions in support of these platforms.

“Bertram’s experienced team and differentiated approach generated strong demand from investors looking for untapped value in the middle market,” said Laurence Smith, Partner at Sixpoint Partners. “We believe Bertram is well positioned to continue generating strong results in the lower middle market, and we look forward to continuing our partnership with the Bertram team.”

Kirkland & Ellis provided legal counsel in connection with Fund III.

About Bertram Capital

With over $1.3 billion in committed capital, Bertram Capital is a private equity firm targeting investments in lower middle market companies. By supplying flexible investment capital and committing a wealth of operational and strategic resources to each investment, we make it our core objective to move companies, management teams, and employees toward unlocking their full potential. Visit www.bcap.com for more information.

About Sixpoint Partners

Sixpoint Partners is a leading global investment bank focused on a diversified set of services and solutions for the middle-market private equity industry. The firm’s core areas of focus include (i) primary fund placement, (ii) secondaries advisory and (iii) co-investment placement across a wide range of industries, strategies and geographies. Sixpoint Partners has a reputation for its direct, results-driven style and for delivering innovative solutions to complex problems in order to create long-term value for clients. Sixpoint is headquartered in New York with offices in Chicago, San Francisco, Austin and Hong Kong. For more information, please visit http://www.sixpointpartners.com/.

Sixpoint Partners, LLC, is a registered broker/dealer, member FINRA (http://www.finra.org) and SIPC (http://www.sipc.org). Sixpoint Partners Asia Limited is licensed by the Securities and Futures Commission (http://www.sfc.hk).

For Bertram Capital, please contact:

David Hellier

Bertram Capital

(650) 358-5000

For Sixpoint Partners, please contact:

Larry Smith, Partner

212-751-8690